UK Cyber Insurance Market 2024-2032

According to IMARC Group's report titled "UK Cyber Insurance Market Report by Component (Solution, Services), Insurance Type (Packaged, Stand-alone), Organization Size (Small and Medium Enterprises, Large Enterprises), End Use Industry (BFSI, Healthcare, IT and Telecom, Retail, Others), and Region 2024-2032", the report presents a thorough review featuring the market share, growth, share, trends, and research of the industry.

How Bis is the UK Cyber Insurance Industry ?

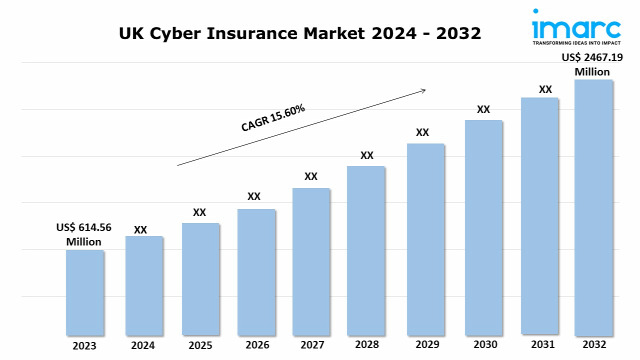

The UK cyber insurance market was valued at USD 614.56 Million in 2023 and is projected to grow to USD 2467.19 Million by 2032, with an expected compound annual growth rate (CAGR) of 15.60% from 2024 to 2032.

UK Cyber Insurance Market Trends:

UK Cyber Insurance Market Trends:

The market in the United Kingdom is primarily driven by the increasing number of cyberattacks and data breaches, which is raising the demand for robust risk management solutions among businesses. Additionally, the growing reliance on digital platforms and technologies across various sectors is adding to the importance of cybersecurity measures and insurance coverage, which is also providing an impetus to the market.

Moreover, stringent data protection regulations, including the general data protection regulation (GDPR), are compelling organizations to adopt comprehensive insurance policies, resulting in significant market expansion. In addition to this, the expanding awareness regarding potential financial repercussions from cyber incidents is encouraging enterprises to seek proactive insurance solutions, thereby creating lucrative opportunities for the market. Furthermore, the rising adoption of cyber insurance among small and medium-sized enterprises (SMEs) is strengthening market growth.

Request free sample copy of the report: https://www.imarcgroup.com/uk-cyber-insurance-market/requestsample

UK Cyber Insurance Market Scope and Growth Analysis:

The scope of the market in the United Kingdom is significantly expanding due to the rising recognition of cybersecurity as an essential part of business continuity strategies. Additionally, continual advancements in risk assessment tools are aiding insurers in offering more customized solutions to clients, which is enhancing the market scope. As per market analysis, the incorporation of predictive analytics and artificial intelligence (AI) in assessing cyber risks is enhancing the efficiency of underwriting processes, which is also contributing to market development.

Moreover, the availability of policies covering a range of cyber-related damages, from data breaches to business interruptions, is appealing to diverse business needs, further enhancing the market scope. In addition to this, the proliferation of cyber awareness initiatives and training programs in the corporate sector is broadening the scope of the market. Furthermore, the emergence of new industry standards and compliance requirements is reinforcing the significance of comprehensive coverage and expanding market potential. The scope of the market is further enhanced by sustainable practices, including eco-friendly policy documentation and operations, which resonate with environmentally conscious businesses.

We explore the factors propelling the UK cyber insurance market growth, including technological advancements, consumer behaviors, and regulatory changes.

UK Cyber Insurance Market Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest UK cyber insurance market share. It includes forecasts for the period 2024-2032 and historical data from 2018-2023 for the following segments.

Component Insights:

- Solution

- Services

Insurance Type Insights:

- Packaged

- Stand-alone

Organization Size Insights:

- Small and Medium Enterprises

- Large Enterprises

End Use Industry Insights:

- BFSI

- Healthcare

- IT and Telecom

- Retail

- Others

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

Top Players Analysis:

The report provides a detailed analysis of the competitive environment. It covers various aspects such as market structure, positioning of key players, top strategies for success, a competitive dashboard, and a company evaluation quadrant. Furthermore, the report includes comprehensive profiles of all major companies.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=24974&flag=C

Other Key Points Covered in the Report:

- COVID-19 Impact on the Market

- Porter's Five Forces Analysis

- Strategic Recommendations

- Market Dynamics

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

- Top Winning Strategies

- Recent Industry News

- Key Technological Trends & Development

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145